"Come for the tool, stay for the network" is a classic strategy for bootstrapping social networks. It aimed to solve a hard problem: how do you convince people to join your social network when there's nobody else to socialize with?

One approach is to build a single-player tool that gets people to use the product. Over time, as more people use the single-player tool, you then add social features such as likes, comments, follows, etc. to plant the seeds for a defensible network.

Today, with the rise of creator-focused platforms, this mantra is evolving into: "come for the creator, stay for the network." Creator-focused platforms realize that wherever the creator goes, the audience and attention follows. As a result, platforms bootstrap their network by attracting top creators.

The go-to-market strategy can generally be summarized as:

Attract top creators with compelling features and / or a bag 💰

Creators bring their audience

Add features to retain the creator and their audience long-term

It's no secret that creator-focused platforms like Instagram, TikTok, Snap, Spotify, OnlyFans, Substack, and Triller (lol) are offering massive bags to attract top creators and their audiences.

However, there's a few issues with this model:

It's hard to make a sustainable living unless you're a top creator

Creator payouts are determined by opaque processes

Content and social graphs are rarely portable across platforms

In my job at Mirror, I think a lot about how to build products that put more power back in the hands of creators and their audiences. But we aren't a "company", in the traditional sense. We are building a creator-focused protocol. We work with creators to understand their needs, write smart contracts, deploy them to the Ethereum network, and build tools for creators to use these smart contracts to solve their problems.

Instead of "come for the creator, stay for the network", I think the mantra of creator-focused protocols will be more like "come for the creator, stay for the economy."

Decentralized protocols aren't social networks. They're cryptoeconomic networks.

Here's the difference.

A social network is:

Owned by shareholders (which skews towards finance firms, executives, board directors, and early employees)

Governed by shareholders (in practice, governance is usually controlled by the board, CEO, and sometimes activist investors)

Most code is private

Data is secured by the company's engineering team

The network becomes global over time

A cryptoeconomic network is:

Owned by the community

Governed by the community

Open source

Secured through distributed consensus, cryptography, and public / private key pairs

Global from day one

Are cryptoeconomic networks perfect? Hell no.

But the point is, creator-focused protocols will be more like internet-native economies than traditional social networks. No more board of directors, executive team, shareholders, top-down product development, opaque payment schemes, taxation without representation, or walled gardens.

Creator-focused protocols will have community-led committees, native protocol tokens for governance, value capture, and utility, decentralized grant programs, universal creator income, an open developer ecosystem, pseudonymous collectives, degen investment clubs, protocol politicians, and more.

A couple years ago this may have sounded like another one of those idealistic crypto narratives that would never actually work in practice. But it's already happening. Since 2018, DeFi protocols like Uniswap, Compound, and AAVE have earned billion dollar treasuries, launched protocol tokens, and started experimenting with community-led initiatives like grant programs.

Over the next few years, I think creator-focused protocols will reach a similar scale.

But to get there, it will probably take an iterative approach. Similar to how social networks start off looking like toys but eventually evolve into something serious, protocols also need to go through their own natural selection process.

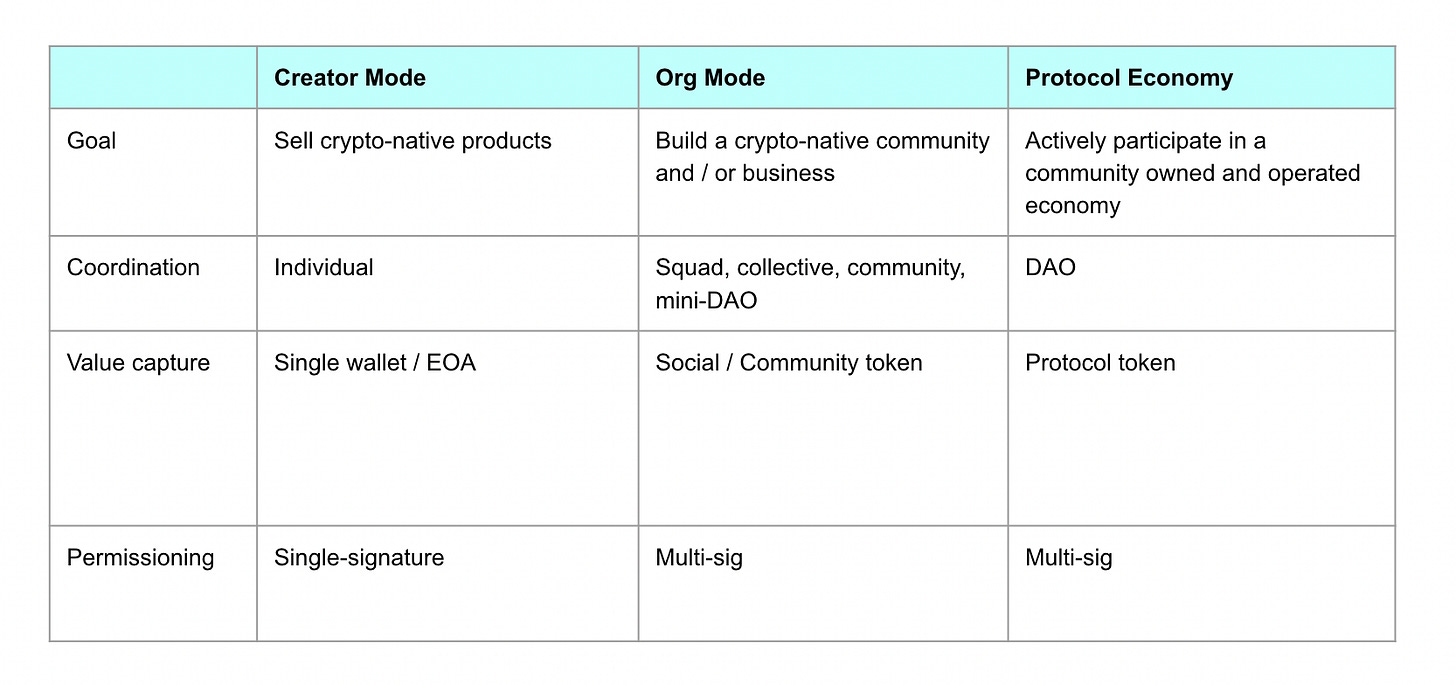

I think successful creator-focused protocols will go through three phases:

Phase 1: Creator Mode

Phase 2: Org. Mode

Phase 3: A Protocol Economy

Here's a high level overview of each phase

With decentralized protocols, "come for the creator, stay for the network" becomes "come for the creator, stay for the economy". Creators will have ownership stakes in the crypto economies they're building. They'll be incentivized to hype up other creators. To invest in the community. To direct traffic. To provide support. Fans, curators, and community leaders alike.

But how do we get there?

In the rest of this post, I'll sketch out some rough thoughts on the milestones for each phase. To start, let's look at the first phase - Creator Mode.

Phase One: Creator Mode

In creator mode, the goal is to:

"Help creators sell crypto-native products."

Helping creators generate on-chain revenue through crypto-native products is a strategic first step for a few reasons:

Convinces creators that it's worth spending more time using crypto protocols

Gets a creator's audience to download a wallet and on-ramp to ETH

Provides a foundation for future on-chain experiments

In terms of deciding what to build, I like Li Jin's framework for creator lifecycles. There are four stages:

Create something

Build audience

Monetize

Manage and grow business

Today, crypto's killer feature for creators is monetizing through NFTs. Over time, I think crypto will get better at other stages like helping creator's build their audience through token rewards and enabling new content formats. But for now, as a creator-focused protocol, your best bet is to help creators monetize (given all the interest, activity, and novel use cases around NFTs).

At Mirror, we've built tools focused on the first and third stages of the creator lifecycle: create something and monetize.

Our fearless leader, Denis, realized that all creative work has a story to tell and that long form writing was one of the best ways to do so. As a result, the team has spent the past few months building a crypto-native publishing stack for creators to tell their stories. Here are a few components:

Decentralized identity using ENS. When you sign up for Mirror, you also register an ENS domain using your key. This ENS domain is basically a self-custodied Twitter username and Cash App handle. It's your social identity and economic identity. Soon, we're adding the ability to accept tips to an ENS domain and route funds to other ENS domains on Mirror.

Decentralized storage using Arweave. All posts on Mirror are signed by your key and stored as a digest on Arweave. We plan on building a tool where people can click a button to export all their posts on Mirror to easily migrate to another publishing tool if they ever choose to.

Markdown editor. Still in the early stages but the long-term vision is to have a Notion-like block based editor. You'll be able to embed crypto-native versions of crowdfunds, auctions, and global payments right in your post as easily as you can embed an image.

At Mirror, we also realized that creative work needs capital to sustain itself. Given that, we've also built a suite of smart contracts and a web app to help creators fund their work. A few examples include:

Tokenized crowdfunds. Raise ETH from anybody in the world with an Ethereum wallet. One author recently raised $50k for an upcoming novel. The crowdfund is tokenized by issuing an ERC20 token to anyone that contributes ETH to the crowdfund. The crowdfund creator can then tie revenue from NFT sales back to the crowdfund contract and token holders can redeem their tokens for a portion of the sales. This has been called a Patronage + Ownership model. Why subscribe when you can invest? For more technical details, check this out.

Reserve auctions. There are many ways to sell NFTs but reserve auctions are quickly becoming the best price discovery mechanism. Plus they're a lot of fun. As the NFT seller, you set a minimum price and the auction duration. Once the minimum bid is hit, it kicks off a clock based on the duration set by the seller. If a bid come in within the last 15 minutes, the clock is reset to 15 minutes. Mario from The Generalist recently teamed up with Jack Butcher of Visualize Value to auction an NFT that sold for ~$45k.

Revenue splits. In web2, if you reference someone in your essay by linking out to their Twitter profile or Substack, you're rewarding them with attention. It's then up to the other person to convert that attention into cash. But what if you could financially reward anybody in the world, directly? At Mirror, we recently deployed a revenue split contract that allows you to split sales with any Ethereum address. Packy from Not Boring recently used this feature to split $5k in NFT sales with 16 contributors.

Building a protocol during the Creator Mode phase is hard because you don't have much information. Also, crypto is notoriously difficult to use. Creators are used to slick onboarding flows. Not signing messages through Metamask, paying gas fees, and waiting five minutes for a transaction to be confirmed on-chain.

But we view every experiment as a chance to learn something new about the market and incorporate it back into product development. Here are a few principles we've used to guide us during this initial phase:

Launch features with a specific use case in mind and then generalize it. So far, our go-to-market strategy at Mirror has relied on partnering with creators on a very specific experiment they want to run. It usually starts with them asking us if doing a certain thing is possible. We go back and forth and scope out a reasonable solution that can be implemented in a couple weeks while still accomplishing their goals. We then implement the feature, reflect on learnings, and continue working with creators to iterate on the experience until we're confident to release it to all of our members. Crypto is so new that most creators aren't sure how to use it to accomplish their goals. These experiments serve as a form of documentation for creators to understand what's possible.

Optimize smart contracts for security, mechanism design, composability, and gas efficiency. As an engineer building a crypto protocol, one of the first things you'll realize is that writing smart contracts is a whole different game from any other type of programming. If you're a decent software engineer, you can learn how to write a basic smart contract pretty quickly. But it takes years to build secure, composable, gas-efficient smart contracts that unlock useful functionality. By far the #1 competitive advantage a protocol can have is a team of world-class smart contract engineers. I think it's really hard to build a truly innovative protocol without one. Although I'm nowhere near world-class myself, I've been fortunate to work with some world-class smart contract engineers at Dharma and Mirror. I've noticed the four areas they're great at are: security, mechanism design, composability, and gas efficiency. Don't settle until you find a smart contract engineer that's great at these skills.

Use guarded launches to limit downside risk. Our crowdfunds have a funding limit of 25 ETH (~$55k today). Although we take an extreme amount of precaution before deploying contracts to mainnet, there's always a non-zero risk of vulnerabilities. Having safeguards like funding limits ensures people don't yolo their life savings into a random crowdfund and get rekt because of a vulnerability in a contract. No bueno.

Over the past few months, we've learned a lot about what creators want and how crypto can help them build stronger communities. One of the most common pieces of feedback we've received is that creators want to builrd sustainable recurring-revenue businesses using crypto-native tools. At the same time, they want to ensure their community has a chance to share in the upside.

This leads us to the next phase: Org. Mode.

Phase Two: Org. Mode

In org. mode, the goal is to:

"Help creators and communities build sustainable crypto-native businesses."

Creator mode is about selling crypto-native products. Org. mode is about building crypto-native communities and businesses.

It's kinda like the difference between being an independent artist vs. being signed to a record label. As an independent artist, you're responsible for production, distribution, publishing on streaming platforms, booking live concerts, selling merch, and more. Meanwhile, once you're signed to a record label, many of the implementation details are abstracted away so you can focus more time on creative work. The record label plugs you into a system that makes it easier to produce, distribute, monetize, and grow. For creator-focused protocols, I think the transition from Creator Mode to Org. Mode will look similar (minus the shitty record deals).

But what's the business model for creators? One approach is to connect value to an ERC20 token. Today, most revenue generated on creator-focused protocols goes to an EOA (e.g., an individual's wallet). It's then up to the individual to redistribute the funds themselves, if at all.

However, Org. Mode is about building a crypto-native community with a sustainable business. We can take inspiration from DeFi protocols to understand how to design such a system.

Here's the basic mechanism:

Issue an ERC20 token. Distribution methods could include a crowdsale, a "fair launch"airdrop to anyone that meets specified criteria, a liquidity mining scheme for active participants, or any combination of the above.

Develop on-chain revenue streams. For DeFi protocols, this is usually a transaction fee. For creators and communities, this could include selling 1 of 1 / fractionalized / open edition NFTs, collecting NFTs, access to a community, digital land, crowdfunds, consulting services, programmable subscriptions, etc.

Funnel on-chain revenue to a treasury contract. Sales generated by the community flow to an on-chain treasury contract. The treasury is controlled by a multi-sig wallet which submits transactions based on community governance.

Redistribute funds through community governance. If the community is optimizing for long-term growth, they may vote for a "buy back and build" strategy where the treasury buys back tokens on the open market and uses them to fund community growth initiatives. Alternatively, the community could optimize for short-term liquidity by offering dividends to token holders.

Most creators / communities in crypto aren't as sophisticated as DeFi protocols because the tooling doesn't exist yet. At best, they may stitch together a bunch of disparate tools. Yet, there's still a lot to desire.

In web2, there's a mature stack for building communities and businesses. Tooling for stuff like:

Financing

Payment processing

Monetization

Marketing automation

Product analytics

In web3, there's an additional set of tools that still need to be refined:

Multi-sig capabilities

On-chain analytics

Governance

Treasury management

Token rewards programs

Shopify makes it easy for anyone to start, manage, and scale an e-commerce store. For creator-focused protocols, Org. Mode is about making it easy for creators to start, manage, and scale a crypto-native community or business.

As a creator-focused protocol, I think it's useful to hone in on a particular use case, provide the tooling it needs to be successful, and expand from there. For Mirror, a few examples could include:

Publication DAOs. Most newsletter products today are optimized for single player mode. One writer. This provides benefits like autonomy and more financial upside (if you're already established). But single player mode also has downsides like a higher workload and the challenge of coming up with consistent growth strategies. A Publication DAO could share the workload, help writers gain distribution, and equitably share financial upside through transparent revenue splits. Here's a detailed example of what a Publication DAO could look like.

Investment clubs. As we've seen with r/wallstreetbets and $DOGE, people love investing together. It's part entertainment. Part collective action. Part fuck it I'm gonna ape. Over the past few months in crypto, investment clubs have emerged to coordinate and curate valuable NFT collections. PleasrDAO is a decentralized investment club that was formed over Twitter to purchase an NFT by pplpleasr. Recently, PleasrDAO got into an epic bidding war for Edward Snowden's first NFT and they won with a final bid of 2,224 ETH (~$4.7M today). Investment clubs have also been called curators and I believe they'll be some of the most important stakeholders in the emerging crypto economy. In the past, curators like Vogue, Hypebeast, and TechCrunch decided what was cool and what wasn't. Soon, decentralized curators like PleasrDAO, $WHALE, SeedClub, $FWB, and Flamingo DAO will specialize in nice verticals and invest in the highest potential creators, communities, and projects.

Decentralized grant programs. Pretty much every creator-focused platform in web2 has a creator grant program. TikTok, Snap, OnlyFans, Substack, etc. In web2, these programs are a clever way to acquire top creators, get their audience to join your platform, and retain them over time. But the issue is that these grant programs are opaque and cash-based with little to no equity. I think web3 grant programs will look very different. DeFi protocols like Uniswap, Compound, and AAVE have started piloting their own grant programs and I'm excited to watch them evolve. For a creator-focused protocol, a grant program could work like this: creators apply for the grant on a public forum, community members contribute ETH to a pool and receive ERC20 tokens, contributors stake their ERC20s to vote on which creators should receive funding, after a certain time period the top x creators share the pool and are rewarded with protocol tokens so they have skin in the game. There's a lot that needs to be figured out here but the general idea is to make the process more transparent and to give creators more ownership over their work. These days it seems like everytopcreator is starting their own VC fund. In web3, I could see this model evolve where top creators start grant programs and allow their community to decide how the funds should be allocated.

Over the past year, creator-focused protocols have been iterating on Creator Mode. I think the next couple years are going to be about transitioning to building tools that enable Org. Mode.

Looking even further ahead, what's after Org. Mode? As your protocol builds tools to help creators and communities start, manage, and scale crypto-native businesses, it becomes time to think about how to decentralize the protocol itself. This brings us to the final boss-level phase: A Protocol Economy.

Phase Three: A Protocol Economy

In the Protocol Economy phase, the goal is to:

"Build a community owned and operated protocol with minimal involvement from the initial development team. Ongoing development is driven by community-led committees with active participation from creators, communities, and a developer ecosystem."

A Protocol Economy is what separates web3 protocols from web2 companies. One of my favorite protocols to study is Yearn. Insiders describe it as a multicellular organism, not a corporation. There's no board of directors. No CEO. No VCs. No HR department. Instead, it started as a solo open source project and evolved into a "collective of contributors".

But, does it actually work? Only time will tell, but so far they've coordinated to make really difficult decisions without blowing up the community. For example, community members recently voted to increase the protocol's (previously sacred) token supply cap to fund protocol development. They've also proposed one of the most sophisticated decentralized governance systems in all of crypto. (I highly recommend reading this and this to get a sense of their culture)***.*** Today, their protocol token $YFI has a $1.4B market cap. Not bad for what started off as a one-person open source project ten months ago.

Although Yearn was a fully decentralized protocol from day one, there's a lot we can learn even if we take a phased approach like the one outlined so far. DeFi protocols like Uniswap and Compound took the phased approach but have began progressively decentralizing over the past few months. They've incorporated best practices from projects like Yearn and developed their own learnings while transitioning to the Protocol Economy phase.

Here's a few key elements creator-focused protocols may want to consider during this phase:

A protocol token. Protocol tokens tend to serve two main functions: currency and capital. When a protocol token serves as currency, it's primarily used for consumption, has a short-term focus, high velocity, and is a medium of exchange / unit of account. When a protocol token serves as capital, it's used as a tool to govern, has a long-term focus, low velocity, and is a store of value (source). Sometimes, a protocol token switches from one function to another through community governance. For example, Yearn's protocol token, $YFI, was originally viewed as currency. $YFI holders received dividends and many community members were obsessed with the price action. However, some community members realized those funds may be better spent by paying core contributors to improve the protocol. As a result, the community voted to increase the token supply cap and diverted more of the treasury to core contributors instead of speculative token holders. With this change, the protocol token went from currency to capital. In a protocol economy, the token can be about more than just "number go up". It can be an instrument for change throughout the protocol. Currency and capital. For creator-focused protocols, this capital can be used to share more of the upside with creators. This could align incentives and generate more long-term growth for the protocol. You could end up seeing deals structured similar to a startup employee's compensation package. There could be token lockup periods and vesting schedules. Frankly, I think platforms should reward top creators the same way they reward top employees.

Third party developer ecosystem. In a Protocol Economy, the initial development team can't unilaterally change the protocol. Instead, the protocol will need to set up a ✨ thriving ✨ developer ecosystem with a suite of tools. These include: audited / well-tested / well-documented smart contracts, documentation describing the entire system, subgraphs to query on-chain data, SDK's for integrating smart contracts, grant programs to fund new projects, bug bounties to improve the protocol, and clear avenues for technical support. One key difference between web2 and web3 is that on-chain data is public. As a result, you could see creator-focused protocols having tens or hundreds of different frontend clients built by third party teams. These clients would use the logic and data from the protocol's smart contracts but could also compose them with other protocol's smart contracts to create something entirely new. It's like if the content and algorithms on Instagram, TikTok, Twitter, YouTube, etc. were publicly accessible. You could compose and remix functionality in crazy ways. There could be an app that's exclusively focused on helping creators finance new projects based on their on-chain revenue. Or maybe there's a marketplace to help facilitate collabs across different protocols. Lot's of crazy stuff can happen here.

Community-led committees. By committee, I don't mean those useless committees inside big companies that just meet so they can have free pizza every month. I'm talking about small, focused teams with clear KPI's, domain expertise, and skin in the game. Again, Yearn seems to be leading the way here. Over the past few months, they've noticed a few teams emerge organically. Teams for operations, development, budget control, and big brain energy, to name a few. As a result, community members proposed creating formal "yTeams". Each yTeam is empowered to make decisions regarding their domain. Whether it's how to spend the budget, defining the development roadmap, or coming up with new yield farming schemes. Who would've thought that decentralized protocols would choose to have so much structure? It reminds me of one of my favorite quotes from Vitalik: "To me, the goal of crypto was never to remove the need for all trust. Rather, the goal of crypto is to give people access to cryptographic and economic building blocks that give people more choice in whom to trust". Community-led committees are chosen by their peers and are a vital force in pushing the protocol forward.

Community benefit programs. One of the most common arguments against web2 creator-focused platforms is that they take more than they give. To a certain degree, their take rates could be viewed as a form of taxation without representation. Of course, web2 platforms provide key services like distribution, tools for content creation, payment processing, etc. But the key question is, are they taking more than they give? And who should decide? In web3, the decision is in the hands of the community. In DeFi protocol economies, the most common community benefit program is a grant program. Top protocols allocate around $1M a quarter to projects they deem beneficial to the ecosystem. For creator-focused protocols, I think there's a number of creator-specific community benefit programs that could be interesting. Stuff like universal creator income, insurance for smart contract risk, automated wealth management services, p2p zero-interest loans, etc. etc. This is the area I'm most excited to see evolve. I'm confident that communities for creator-focused protocols are going to come up with some insanely creative collective bargaining schemes to ensure they're able to not just succeed as individuals, but to succeed as a squad.

A Protocol Economy is the boss-level phase for creator-focused protocols. But it's also the phase that's radically different from existing platforms. As creators and communities become key contributors to protocol economies, I believe crypto will go from looking like a toy to being recognized as the generation defining movement that it has the potential to be.

Closing Thoughts

Although we walked through the three phases - Creator Mode, Org. Mode, and Protocol Economy - in a specific order, it's still important to have the end-state in mind from the earliest days of protocol development. Who you hire. Who you attract as the first customers and community members. What your website copy says. Early decisions impact your ability to move through the other phases.

So, how might "come for the creator, stay for the economy" end up looking in practice?

In a few years, I imagine people flocking to a creator-focused protocol because one of their favorite creators recently joined. As they build a reputation on the protocol, they may qualify to apply for a monthly stipend from the treasury to quit their job and become a full-time content creator. Or maybe they want to deposit their crypto into the community's automated wealth management system. Or maybe they raise an investment fund from the protocol treasury based on their reputation as a curator. In mature creator-focused protocols, I believe there will be emergent opportunities like these for creators, curators, community leaders, developers, protocol politicians, and passive consumers alike.

They come for the creator, but stay for the economy.

At a superficial level, they're bound by the protocol token. On a deeper level, they're bound by the desire to succeed together. The heart and soul of these economies isn't an invisible hand driven solely by self-interest. Nope. Instead, it's the feathered dinosaur that's a community leader on a mission "to cohere & align collective intelligence". It's the bunny that ships code like his life depends on it. It's the bag holders that donated 10% of their earnings back to the protocol to fund future development.

It's a new type of economy.

Shoutout to Denis, Graeme, and Jon-Kyle for discussions that led to these thoughts.